Financial calculator and you can devices

Disregard the return is actually a function of to buy they proper and you may funding it proper. Similarly, restoration difficulties may well not hunt a problem when you’re excited to increase control of a home, nevertheless ongoing worries can be severely impression how you feel on the ownership. This is a helpful initial step ahead of conversing with a good Loanworx mortgage specialist, because provides you with a better image of the value and you will can help you package your house travel effectively.

Enjoy the capacity for conference no matter where and whenever is right for you finest. ANZ Mobile Lenders is actually faithful ANZ Home loan Gurus who’ll offer personalised provider where and when it suits you. Financing in order to Value ratio (LVR) is the overall number you have got lent for your loan since the a percentage of your property really worth. Minimal credit count are $100,one hundred thousand as entitled to an excellent Digi Mortgage. Weekly / fortnightly numbers just apply for many who’lso are spending because of the Direct Debit (install with CommBank).

A loan per state – Borrowing Power Calculator Australia

You will often be better off making payments to the any present fund to be able to tick out of your liabilities ahead of with your money examined because of the a loan provider. For example, their credit limitations is generally set high or if you could possibly get be doing irregular self-employed functions. AssetsWhen loan providers determine your house application for the loan, the complete property value property you possess will be key to determining what you can do in order to meet mortgage repayments. All the information provided with YourInvestmentPropertyMag.com.au are general in nature and won’t be the cause of your own personal objectives, finances, or means.

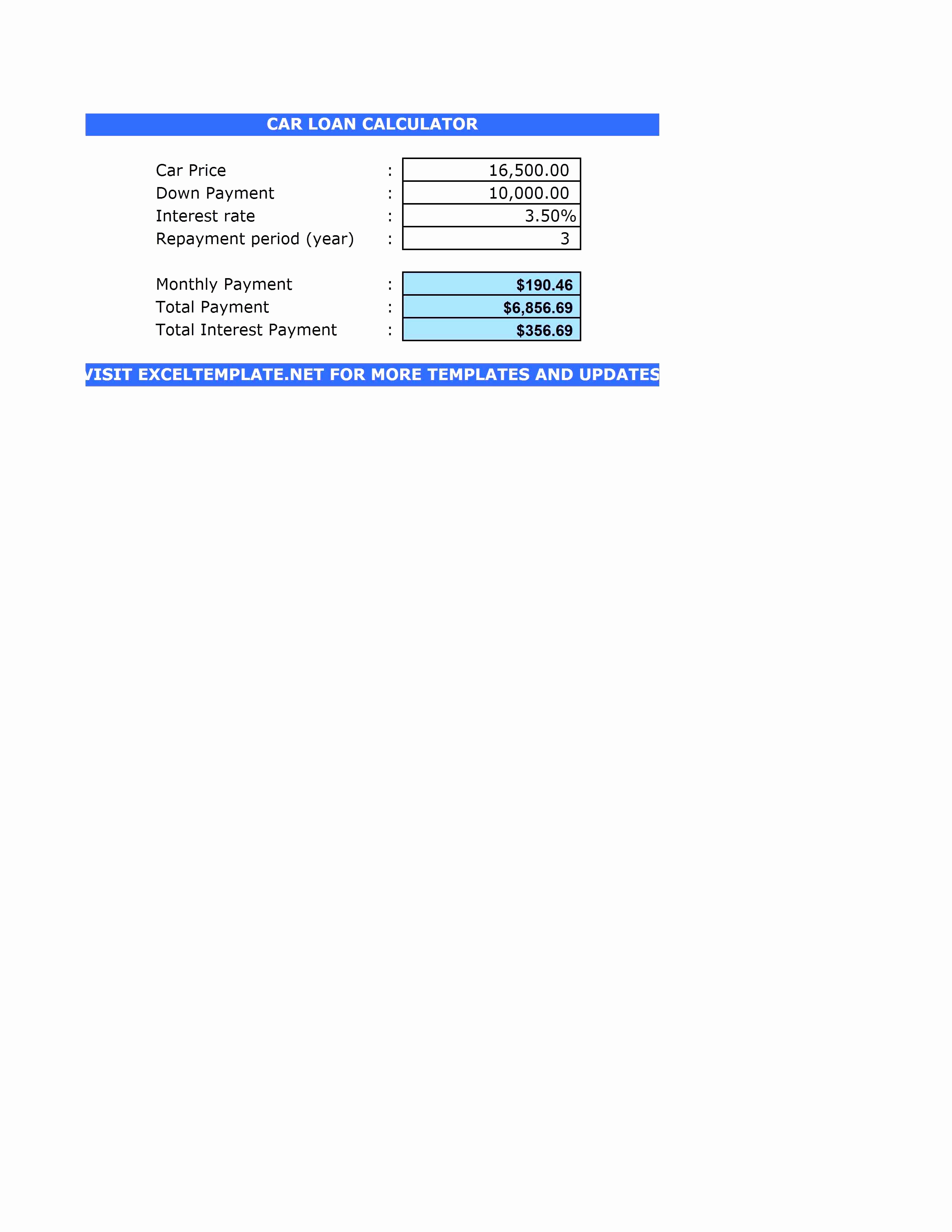

Following the repaired months, your rates often change to the newest relevant variable price to possess a dominating and you can desire loan. This can be an offer that is provided for illustrative objectives only. Centered on both of these items of guidance, our very own calculator are working it is magic to determine simply how much home you’re able to afford.

A home Calculator Terms & Significance

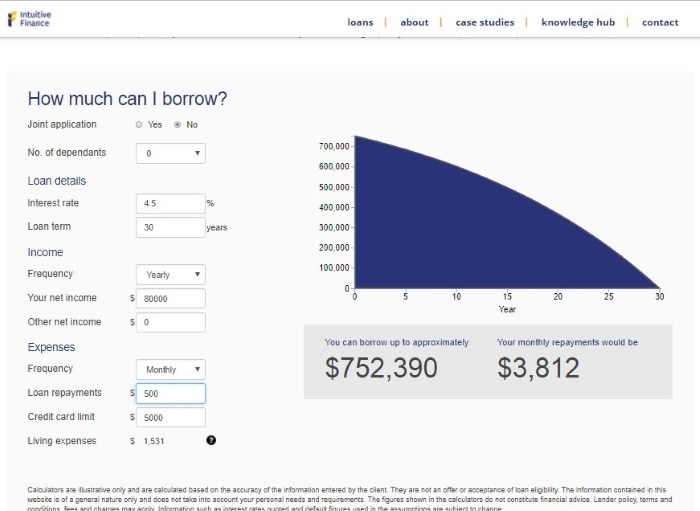

It doesn’t account for all facets of the financial predicament, nor does it constitute a pre-approval or formal credit evaluation. If or not you’re also investigating options for your ideal family or a smart financing possessions, our very own Borrowing Energy Calculator takes the new guesswork out from the formula. Put it to use evaluate scenarios, to alter the number, and find out how change on the earnings or expenditures make a difference your own borrowing from the bank electricity.

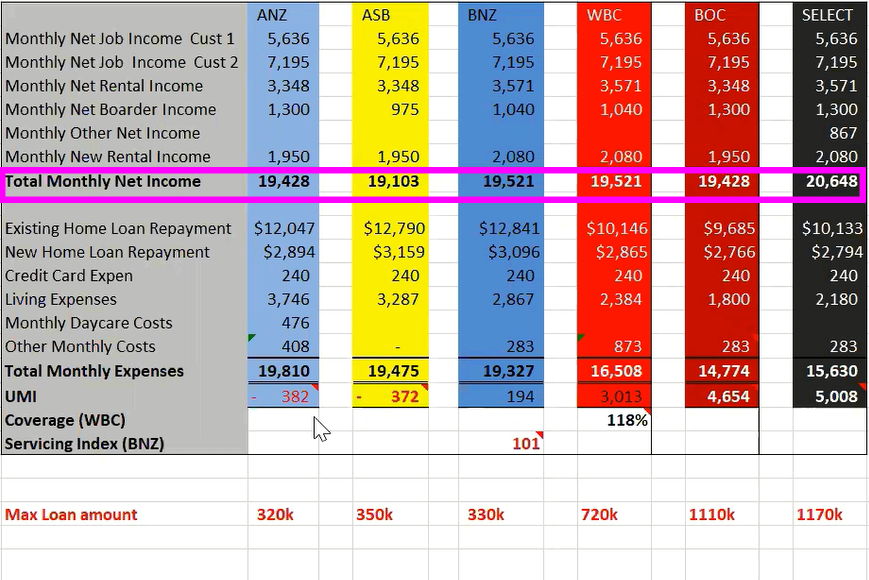

Your Borrowing Power Calculator Australia credit report (or credit history) facts the amount of money your’ve borrowed, how many borrowing from the bank software your’ve produced, one refinancing of debts, plus power to build punctual money. The put is one of the fundamental affects on your own borrowing from the bank electricity. This is because a bigger put setting high credit ability, all the way down desire on your own mortgage and you can quicker costs. To locate a crude thought of the borrowing from the bank capacity, you need to use an internet borrowing from the bank energy calculator. You’ll must connect on the money, costs or other suggestions one has an effect on your money. Although not, all financial and you can bank possesses its own assessment speed to have estimating their credit power, for this reason their borrowing from the bank energy can differ ranging from other loan providers.

Having fun with the borrowing from the bank energy calculator is relatively easy. The factors prioritised and taken into account can vary widely according for the financial, thus understand that the credit ability is far more of a variety than an explicit property value just how much you should use acquire. Borrowing energy refers to the financing endurance otherwise restriction enforced to your your by lenders according to your financial situation. Once getting most of these number regarding the assigned ranks on the Just how much should i Obtain? Thus given David’s specific items, it’s estimated that his bank would be prepared to financing him to on the $491,677.

If a loan provider is worried that the costs are way too large, they could lower your borrowing capacity. If your money to arrive however isn’t enough, there are many a way to your income. You could chat to the movie director regarding the a pay increase, enhance your times for those who’re also part-time, search for a different and higher-spending job, otherwise imagine an additional income load.

Is all of the consumers lingering expenses elizabeth.grams. food, costs, tools, knowledge, entertainment. Unloan acknowledges the conventional Owners of the causes round the Australian continent since the the newest persisted custodians out of Country and you will Society. We pay our value to help you Basic Places individuals and their Parents, previous and provide.

Mortgage Hindsight Questionnaire

Assessable income ‘s the level of income the bank is actually having fun with in their formula when determining their borrowing from the bank power (mortgage serviceability). Normally, very lenders play with equivalent ways to determine borrowing from the bank ability, for instance the controversial Household Expenditure Size (HEM). However, for each can get a unique way of figuring the costs and you may borrowing capacity centered on the cravings to own chance. Lenders will likely think about if you may have any present debts, when you’re having fun with a great guarantor for your home loan, plus the rate of interest for the mortgage tool you are applying to. The brand new Borrowing Energy calculations are created as the helpful information just and you will are rates based on the advice your input.

Your HECS (Advanced schooling Share Plan) personal debt could affect the borrowing from the bank energy by eliminating the amount of earnings designed for financing money. Loan providers think HECS payments within your total bills, which can decrease your borrowing capability. The fresh feeling utilizes the dimensions of their HECS loans and you can your own fees plan, because these issues influence the throwaway money and you can capacity to manage more mortgage repayments. It is important to cause for HECS debt when evaluating the credit capacity to be sure you is also conveniently perform your entire financial responsibilities. ˇ An enthusiastic an indication rate of interest and you will projected costs commonly a formal acceptance for a loan, so don’t enter into one economic responsibilities centered on it.

When you are a preexisting Westpac customers, we might get in touch with you having related condition, also provides, otherwise guidance which can be of interest. If you want not to ever become called, you might choose aside any time by simply following the newest guidelines considering within communications or because of the upgrading your preferences. Any tax advice revealed are standard in the wild and is also not income tax advice or the basics of income tax laws and regulations.

Which document outlines the brand new cost or other suggestions for the standard products in a consistent format, enabling you to without difficulty evaluate some other lenders. Score an amount diversity estimatedisclaimerof exactly how much a house you’ll offer to own, with choices to guess equitydisclaimerif your currently individual property. Lenders are aware that paying models are very different considerably, even among people who have the same income.

Right here, we falter what borrowing strength is, the way it’s calculated and you can, if this’s perhaps not in which you like it to be, the best way to try to raise it. Whether it’s a financial investment or a different family, you happen to be questioning how much your’ll manage to spend as the a first-household client – in other words, your own borrowing power. A cost one to quotes the worth of monthly repayments as made to play with by the people in order to meet the loan. An additional fee and their rate of interest since the a great dealing mechanism if financing payments go up. Based on Finder research, 2 in the 5 Australians is actually investing more than 29% of the earnings to invest its home loan repayments. Because the a rough guideline, you won’t want to save money than just 30% of one’s money to your mortgage repayments.

Categories: Air Conditioning

Contact Us